Navigating healthcare spending accounts can be challenging, especially when determining which medical products qualify for reimbursement. Compression socks represent a nuanced category, balancing between medical necessity and wellness product. For individuals managing Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), understanding when compression socks qualify for reimbursement can save money while ensuring proper foot health. This guide explores eligibility requirements, documentation needs, and practical considerations for using healthcare spending accounts to purchase compression socks.

Fundamentals of HSA and FSA Accounts: A Brief Overview

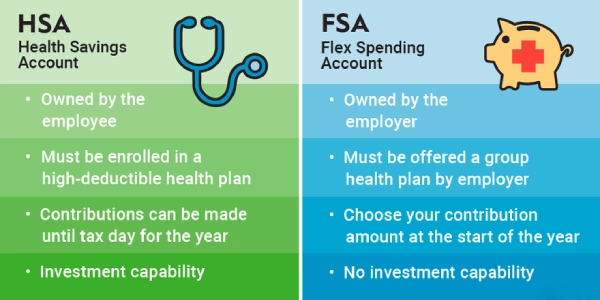

What Is an HSA?

- Linked to high-deductible health plans.

- Funds roll over year to year.

- More flexible for ongoing purchases like compression hosiery.

What Is an FSA?

- Employer-sponsored with a “use it or lose it” rule.

- Requires spending within the plan year or limited grace period.

- Creates predictable seasonal demand for eligible medical products.

👉 For retailers: HSAs mean long-term, repeat purchases. FSAs create time-sensitive buying patterns that you can align promotions with—such as end-of-year reminders to spend remaining balances.

Contribution Limits

- For 2023, HSA contribution limits were $3,850 for individuals and $7,750 for families. People age 55 or older can contribute an extra $1,000 as a “catch-up” amount.

- For FSAs, the contribution limit was $3,050 in 2023, though employers may set lower limits.

Defining Medical Necessity for Compression Socks

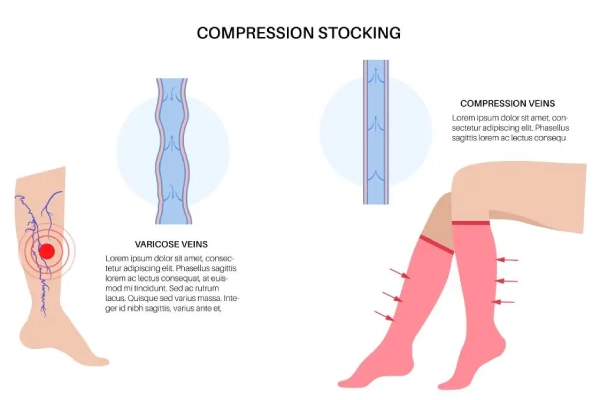

Under HSA and FSA guidelines, “medical necessity” is the key factor that determines whether compression socks qualify as reimbursable medical expenses. This distinction separates products prescribed for the treatment of a diagnosed condition from those marketed as general wellness or comfort items.

When Are Compression Socks Considered Medically Necessary?

To meet eligibility requirements, compression socks must be prescribed or recommended to manage a recognized health condition. Common qualifying conditions include:

- Chronic venous insufficiency – supports venous return and reduces leg swelling.

- Deep vein thrombosis (DVT) prevention – reduces blood pooling and clot risk.

- Lymphedema – controls lymphatic fluid buildup in the legs.

- Post-surgical recovery – improves circulation and supports healing.

- Severe varicose veins – alleviates pain and slows disease progression.

- Pregnancy-related edema – reduces swelling when recommended by a provider.

- Diabetes with circulation issues – improves blood flow and helps prevent complications.

For more details, the FSAFEDS official expense list confirms that compression hosiery can qualify when linked to medical necessity.

Why Compression Levels Matter

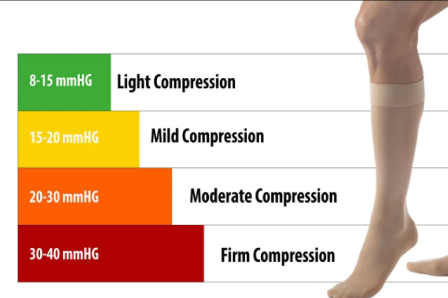

Compression therapy works by applying graduated pressure—tightest at the ankle and gradually decreasing up the leg. Medical-grade compression socks (typically 20 mmHg or higher) are often prescribed because they actively treat circulation problems rather than functioning as simple comfort wear.

Resources such as the HSA Store eligibility list and HealthEquity note that higher-level compression (30–40 mmHg and above) usually requires a prescription to qualify as a tax-advantaged purchase.

| Condition | Why Compression Socks Qualify under HSA/FSA Rules |

|---|---|

| Chronic Venous Insufficiency | Improves venous return, reduces swelling |

| Deep Vein Thrombosis (DVT) | Prevents blood pooling and clot formation |

| Lymphedema | Controls fluid buildup |

| Post-Surgical Recovery | Supports circulation and healing |

| Severe Varicose Veins | Relieves pain, prevents progression |

| Pregnancy-Related Edema | Reduces fluid retention (with provider approval) |

| Diabetes with Circulation Issues | Improves blood flow, reduces risk of complications |

Compression Levels and Eligibility: Understanding the Gradient

Compression level determines both therapeutic benefit and HSA/FSA reimbursement eligibility:

- Mild (8–15 mmHg): Provides basic support for minor swelling, everyday discomfort, or travel. Rarely reimbursed without medical documentation, as it’s mainly considered a wellness item.

- Moderate (15–20 mmHg): May qualify for reimbursement with a healthcare provider’s recommendation. Used for mild to moderate varicose veins, early-stage venous insufficiency, or minor edema. Formal prescriptions strengthen claims.

- Firm (20–30 mmHg): Medical-grade compression typically requires a prescription. Treats moderate to severe varicose veins, post-thrombotic syndrome, moderate edema, and active venous ulcers. Proper documentation establishes medical necessity.

- Extra-Firm (30–40+ mmHg): Highest support for severe venous insufficiency, lymphedema, and acute post-thrombotic conditions. Prescription and professional fitting are usually required to meet reimbursement criteria.

Prescription Requirements: When You Need a Doctor’s Order

For HSA or FSA reimbursement, the need for a prescription is a key factor in determining whether compression socks qualify. Mild compression levels (8–15 mmHg), often marketed as travel or light support socks, may sometimes be eligible without a prescription if linked to specific medical conditions. However, most plan administrators require a doctor’s prescription for compression levels of 20 mmHg and above.

Who Can Prescribe Compression Socks?

A valid prescription must come from a licensed healthcare professional. This can include:

- Primary care physicians

- Vascular specialists

- Phlebologists

- Wound care specialists

- Other qualified providers, depending on your condition

During the consultation, doctors typically review symptoms, may order diagnostic tests, and then determine the appropriate compression level for treatment.

What Should Be Included in a Prescription?

To be accepted for reimbursement, a prescription usually needs the following details:

- The medical diagnosis requires compression therapy

- The specific compression level (measured in mmHg)

- Type of garment (knee-high, thigh-high, pantyhose, or custom fit)

- Quantity prescribed (number of pairs)

- Duration of therapy

- Provider’s full information (name, credentials, signature, contact)

These requirements align with durable medical equipment (DME) prescription standards used by insurance and reimbursement systems (Medicare Coverage Database).

How Long Is a Prescription Valid?

Most prescriptions are valid for 12 months unless otherwise noted by the provider. Chronic conditions such as venous insufficiency or lymphedema may require ongoing therapy, with periodic reassessments to adjust garment type or compression level as needed (Cleveland Clinic – Compression Stockings). Specifically limited by the provider, though some conditions may require more frequent reassessment. For chronic conditions requiring indefinite compression therapy, providers typically establish regular reassessment schedules where they evaluate treatment effectiveness and potentially adjust compression levels or garment types.

Purchasing Channels and Their Impact on Eligibility

The place of purchase directly affects HSA/FSA reimbursement for compression socks. Medical supply and DME providers usually market products as medical devices, accept prescriptions, and issue itemized receipts formatted for insurance and account claims. Pharmacies often qualify, especially when socks are dispensed through the prescription counter. Major chains can flag higher compression levels and typically allow direct HSA/FSA card use. Online medical retailers provide detailed product descriptions, prescription verification, and formatted receipts. Many also process HSA/FSA cards directly. General retailers present the most difficulty, as products may lack medical specifications or receipts suitable for reimbursement. Eligibility can still be established with proper documentation, but responsibility lies with the account holder.

Documentation Requirements for Successful Reimbursement

Proper documentation is the key factor in securing HSA/FSA reimbursement for compression socks. Receipts should clearly state the product type (compression socks or stockings), the exact compression level (mmHg), quantity, purchase date, and total amount. Generic receipts without these details often lead to denied claims.

For higher compression levels (20+ mmHg), most administrators require a valid prescription that specifies the medical condition, compression strength, and garment type. In some cases, a letter of medical necessity may be accepted, especially for moderate compression or ongoing therapy needs.

Claim forms usually require itemized information confirming the socks are prescribed for medical use and not reimbursed elsewhere. Many HSA/FSA administrators provide dedicated forms to capture these details.

Best practice is to maintain organized records for each purchase, including prescriptions or letters of medical necessity, detailed receipts, claim forms, and responses from administrators. Digital record-keeping with secure backup helps prevent documentation loss and supports future reimbursement claims.

Reimbursement Strategies for Different Account Types

HSA strategies provide greater flexibility in both timing and documentation. Eligible compression socks can be purchased directly with HSA debit cards, which simplifies reimbursement when retailers properly code the products. Alternatively, account holders may choose to pay out-of-pocket and file claims later, an approach often used when gathering documentation or managing account balances strategically.

FSA strategies require more time-sensitive planning due to the “use it or lose it” rule. Many administrators issue FSA cards that are accepted at qualified retailers; however, claims must typically be submitted within 30 to 90 days of purchase, depending on the plan rules.

Timing considerations for both account types include aligning compression sock purchases with prescription renewals, funding cycles, and employment changes that may affect account availability. For chronic conditions requiring ongoing compression therapy, establishing consistent purchase patterns can help maximize tax advantages and maintain continuous access to medically necessary products.

Common Reimbursement Challenges and How to Overcome Them

Insufficient documentation is the most common reason compression sock reimbursement claims are denied. This can be avoided by requesting itemized receipts that specify compression level, obtaining prescriptions or medical necessity letters before purchase, and keeping organized files of all related documents.

Compression level mismatches between prescriptions and purchased socks also trigger denials. Account holders should confirm that compression strength, style, and length exactly match medical recommendations. If substitutions are needed, updated documentation from a healthcare provider helps prevent complications.

Coding and classification issues occur when retailers list compression socks as general merchandise instead of medical devices. To reduce this risk, purchase from medical suppliers or pharmacies that use proper coding, and request detailed receipts or supporting documentation.

Administrative errors sometimes result in valid claims being denied. Reviewing denial letters, submitting timely appeals, and keeping communication records with administrators can help resolve disputes and strengthen future claims.

Special Considerations for Specific Populations

Diabetic patients may qualify for compression sock reimbursement when circulation issues are present, but improper use can cause complications with severe neuropathy or arterial disease. Most HSA/FSA administrators require prescriptions specifying the diabetes diagnosis, compression level, and medical necessity.

Pregnant women experiencing significant edema may also qualify when swelling requires medical intervention rather than routine pregnancy support. Documentation should clearly state that compression therapy addresses a medical condition, not general pregnancy discomfort.

Athletes generally face greater reimbursement challenges since compression products are often viewed as recovery aids rather than medical devices. Claims usually require documentation of a medical diagnosis, such as venous insufficiency or rehabilitation after injury, not general performance benefits.

Travelers may be eligible for compression socks to prevent deep vein thrombosis (DVT) when certain risk factors are present, such as a history of prior clotting events, clotting disorders, or a physician’s recommendation. Documentation must demonstrate elevated medical risk beyond routine travel concerns.

Maximizing Benefits: Strategic Approaches to Compression Sock Coverage

Coordinating insurance with HSA/FSA benefits can reduce out-of-pocket costs for compression socks. When prescribed for medical conditions, traditional insurance may cover part of the expense, while HSA/FSA funds can be used for the remaining costs.

Planning replacement schedules also helps maximize reimbursement. Since compression socks lose elasticity after 3–6 months of regular use, aligning purchases with account funding cycles ensures continuous therapy without coverage gaps.

Quality matters as well. Premium compression products may have higher upfront costs but often deliver more consistent pressure, better durability, and improved comfort, making them a cost-effective choice for long-term HSA/FSA use.

Conclusion

Understanding eligibility requirements for compression sock reimbursement through HSA and FSA accounts helps individuals make informed healthcare decisions while maximizing financial benefits. By following documentation rules, meeting prescription needs, and choosing compliant purchasing channels, account holders can integrate compression therapy into their care while using tax-advantaged funds effectively.

Successful reimbursement depends on documenting medical necessity, selecting proper compression levels, securing prescriptions when required, and keeping organized records of all purchases. These steps ensure therapy remains both medically effective and financially accessible through healthcare spending accounts.

Since HSA/FSA policies and reimbursement rules may change, staying updated is important. Consulting healthcare providers, account administrators, or tax professionals offers additional clarity on individual reimbursement opportunities for compression therapy.

FAQ: Common Questions About Compression Sock Eligibility

Are all compression socks automatically HSA/FSA eligible?

No, eligibility depends on medical necessity, compression level, and proper documentation. Lower compression levels (8-15 mmHg) typically require stronger documentation of medical necessity, while higher levels (20+ mmHg) with proper prescriptions generally qualify more readily.

Can I use my HSA/FSA card directly to purchase compression socks?

Yes, if purchased from retailers with proper medical coding systems that identify eligible products. Medical supply companies, many pharmacies, and specialized online retailers often accept direct HSA/FSA payment for qualifying compression products.

Do I need a prescription for every compression sock purchase?

Typically yes for compression levels of 20+ mmHg. Lower compression levels may occasionally qualify without prescriptions if specific medical necessity is documented, but prescriptions significantly strengthen all reimbursement claims regardless of compression level.

How often can I purchase compression socks with my HSA/FSA?

Most plans allow purchases aligned with medically appropriate replacement schedules, typically every 3-6 months, depending on wear patterns and medical needs. Documentation should support the replacement frequency based on medical necessity.

What if my compression sock claim is denied?

Review the specific reason for denial, gather additional documentation addressing the identified issues, and submit a formal appeal following your administrator’s specific procedures. Many initially denied claims succeed on appeal with proper supplementary documentation.