Introduction

China is the country with the largest export volume in the world. If you are a new brand or a newly established e-commerce company and want to purchase some products to sell, then China will be the priority. This article takes compression socks products as an example to help you better understand the import documents you need to prepare.

To import compression socks from China, first, you need to know if you get the import qualification. Then confirm the HS code of compression socks, you can use the same one as nylon socks. Or if you have to use the one which is for compression socks, then there are some medical socks documents to fulfill and submit to your local customs. The last thing is custom clearance documents, this is the same for all the import issues which you can ask your factory to provide.

Import qualification confirmation

The first and most important thing is to make sure that you are qualified to import from China, so your company will need to apply for an import license. The specific application process can be found on the websites of each local government; this is the first step in the import work. or example, in the United States, you can check the official guide on how to get an import license or permit provided by the U.S. government.

Confirmation of HS code

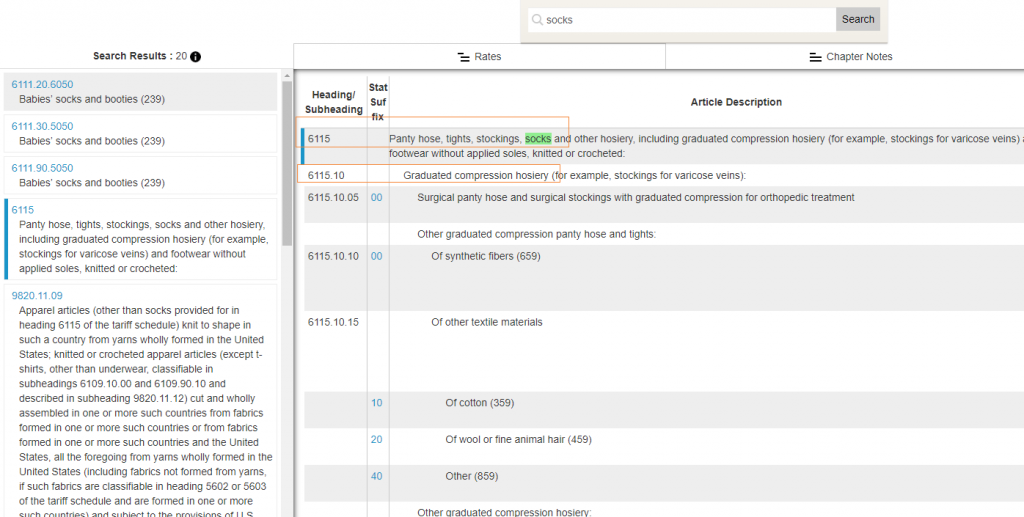

The same product can be described with multiple HS codes and the first 6 numbers of the HS code are uniform for all countries. Compression socks, for example, can be described as socks, or compression socks. The HS codes for knitting socks are 611596 and 611595, while the HS code for compression socks is 611510. Now let's take the United States as an example and see if the HS code corresponds to the Chinese HS code name. The HS code for the USA can be accessed at hts.usitc.gov.

Usually each country has its own dedicated tariff website, which in addition to the HS code also contains the import duty rates for different products. If you cannot find the website, you can also refer to WITS and look for tariffs - uncited trains.

Different duty rates

As the import duty rates vary between HS codes, some of which are even duty-free, so we should be careful when choosing HS codes. Compression socks, for example, the above three HS codes have different tax rates, ranging from a minimum of 10% to a maximum of 18.8%.

Here is a further explanation of the tax rate remarks. As we can see in the diagram, there are two columns. The first column is ordinary and special; each country has a trading partner that enjoys special treatment from both sides. The two countries can enjoy the most preferential tariff treatment when they import and export. Therefore, Special is for this type of country, and the second column is for countries that have erected trade barriers.

For countries that enjoy preferential tariff rates, a certificate of origin is usually required when importing. This can be done by the supplier then you should provide it to the customs together with the duty payment to benefit from the preferential tariff. The tariff rates for other countries can also be found on the website mentioned above.

In addition, the Regional Comprehensive Economic Partnership (RCEP) will come into force in 2022, with 15 countries including China, Japan, South Korea, Australia, and others as members, enabling 90% of products to be imported and exported with zero tariffs, effectively reducing trade and investment costs for these countries.

Custom clearance documents and other certifications

For compression socks, some customers may require the supplier to have relevant medical qualifications, such as FDA, 13485, K510, etc..Then you have to confirm the imported product name before shipping, as the supplier does not have the relevant qualification, which will lead to failure of the import inspection and even risk of product return.

Custom clearance documents are provided by the supplier, it mainly contains a commercial invoice and packing list, which should describe the import and export company's information, tax code, export product name, quantity, and value of the order, etc.

Moreover, assuming that you choose the tax-inclusive shipping channel, then you do not need to provide customs clearance information since it will be covered by the shipper. Our factory has tax DDP air, sea, and railway channels for most European and American countries.

Conclusion

The above are some tips that you should know to import compression socks in China. Hope it will be helpful.

If there’s an inquiry for compression socks or any problems with importing, please also feel free to contact us. We’re Max Hosiery -- 16 years’ experience in socks manufacturing in China.

Follow us below: