Global demand for cycling socks is no longer a tiny side note in the bike industry – it’s riding the same long-term wave as cycling apparel, commuter cycling and athleisure. Please note that this article looks only at market trends, regions and demand evolution – not how to pick a pair.

From “small accessory” to a growing global category

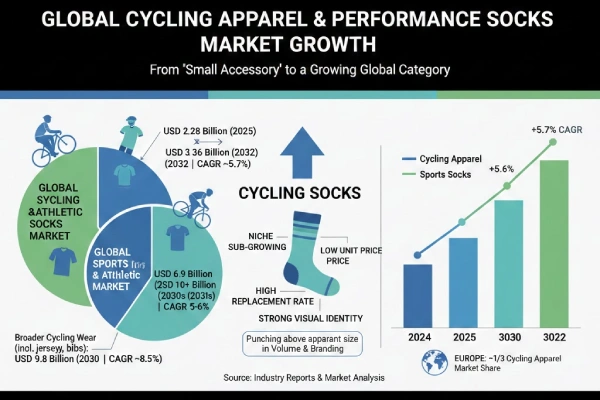

Cycling socks are a niche subsegment, but they sit inside two growing pies at once: the cycling apparel pie & performance/athletic socks pie – two markets that are both growing steadily.

- The global cycling apparel market is projected to grow from about USD 2.28 billion in 2025 to USD 3.36 billion by 2032, at a CAGR of roughly 5.7%, with Europe already holding about one-third of the market.

- The broader cycling wear market (jerseys, bib shorts, outerwear, etc.) is expected to reach nearly USD 9.8 billion by 2030, growing at roughly 8.5% CAGR from the mid-2020s.

- In parallel, sports and athletic socks as a whole are forecast to grow from around USD 6.9 billion in 2024 to over USD 10 billion by the early 2030s, with a CAGR close to 5–6%, driven by fitness participation and athleisure.

Add their natural characteristics — low unit price, high replacement rate, strong visual identity — and you get a category that can punch above its apparent size in terms of both volume and branding.

The Two Engines of Demand: Pro Racing vs. Urban Commuting

Behind the growth of cycling socks, two very different demand engines are pushing the market forward: high-performance sport and everyday mobility. This section looks at them from a portfolio planning angle – Ignoring either engine means leaving growth on the table: performance socks build image and credibility, while commuting and everyday riding bring volume and repeat purchases.

The “Pro” Influence: Wattage and Aerodynamics

One part of the market is pulled by high-performance riding: road races, triathlon, hard training and serious weekend riding.

Riders in this group:

- Follow pro races and often copy the gear they see on screen

- Care about marginal gains in fit, breathability, support and aerodynamics

- Pay attention to technical claims, materials and any kind of performance proof

For them, cycling socks are a small but real part of a performance system: they must lock the foot into a stiff shoe, stay dry, avoid blisters and, at the top end, even contribute to aerodynamics and light compression.

The Commuter Shift: Comfort and Versatility

The second engine is the rapid growth of urban cycling, e-bikes and everyday bike use.

These riders:

- Use the bike for work, errands and social trips

- Wear one pair of socks for many hours and several activities in a day

- Want performance (dry, comfortable, no slipping) but also a normal, office-friendly look

Here, socks are judged less on race features and more on all-day comfort, durability and versatility. Neutral colours, simple designs and fabrics that tolerate frequent washing matter as much as traditional “sports” benefits.

Hot regions: where demand is strongest – and how it looks different

Europe: mature, premium, infrastructure-driven

Europe is currently the largest single region in cycling apparel, with over 30% share of global revenue. Cycling is deeply embedded in many European countries:

- The Netherlands, Denmark, Belgium and the Nordics have very high rates of daily cycling for transport.

- Cities like Amsterdam and Copenhagen see a huge share of trips done by bike, making cycling gear part of everyday life rather than a niche sport.

For cycling socks, that translates into:

- High awareness – people know there is such a thing as a “cycling-specific sock”.

- Strong brand and sustainability expectations – European consumers are more likely to ask about OEKO-TEX, recycled fibres and transparent supply chains.

- Preference for premium and design-driven products – especially when socks match jerseys and bibs as a coordinated kit.

North America: multi-sport, e-commerce-heavy

North America has a smaller share of daily bike commuting but high participation in fitness cycling, weekend road riding, mountain biking and indoor training.

Key characteristics:

- E-commerce dominates: Amazon and brand webstores are the primary channels for socks.

- Consumers are highly responsive to clear problem-solving messages such as “no-blister”, “compression support”, “anti-slip cuff”, and “quick-dry”.

- There is a strong overlap between running, gym and cycling communities. A rider may buy socks that work across multiple sports.

Asia–Pacific: fastest growth & style-driven demand

The Asia–Pacific region is often cited as the fastest-growing area for both cycling wear and athletic socks, fueled by:

- Expanding middle class and urbanisation

- Rising popularity of road cycling, weekend group rides and indoor cycling communities in China, Korea, Japan and Southeast Asia

- Strong social media influence on sports fashion

Consumers here often care about:

- Style and colour first, but still want functional benefits like breathability and comfort

- Fair price points, with multi-pair packs being attractive

- Products that photograph well for social content and “ride shots”

For this region, positioning cycling socks as “high-function, high-aesthetic, good value” is key.

Emerging regions: Latin America, the Middle East, Africa, Eastern Europe

In these regions:

- Bike commuting and sport cycling are growing from a smaller base.

- Infrastructure and climate can be barriers, but early adopters are enthusiastic and often very brand-aware.

Cycling socks here are typically:

- Imported through multi-brand sports retailers or cross-border e-commerce

- Purchased by more committed riders with a higher willingness to pay for performance

For B2B planning, these regions are ideal for: Standardised global bestsellers (core road/MTB socks) and occasional limited editions that tap into local events or clubs.

The upgrade path: from race kit add-on to lifestyle essential

As the market matures, most cycling sock buyers move through a similar journey, shifting from pure performance needs to a blend of comfort, style and versatility.

Stage 1 – Hardcore racers and high-volume athletes

At the beginning of the curve are competitive riders and high-volume athletes. They train often, race regularly and notice every detail of fit, breathability and support. For them, socks are a performance tool: they care about how quickly the fabric dries, how well it locks the foot inside a stiff shoe, and whether new materials or technical features give even a small advantage. Fashion is secondary to function.

Stage 2 – Enthusiasts who want to “look the part”

As riders become more serious but not necessarily professional, their expectations change. They still value comfort and performance, but they also care about how they look in group rides and photos, and whether their kit feels coordinated and “pro”. At this point, socks become part of the visual identity: people start buying multiple colours and patterns to match different jerseys or bikes, and they naturally separate their drawer into lighter pairs for warm days and thicker, more protective options for cooler conditions.

Stage 3 – Commuters and lifestyle riders

Once bikes are woven into daily life, a new set of priorities appears. Commuters and lifestyle riders need socks that stay comfortable for an entire day, not just a 60–90 minute training session. They look for simplicity: easy-care fabrics that can handle frequent washing, enough durability for daily use, and styling that works in the office, a café or at home. At this stage, mid-priced, reliable socks with balanced performance become the quiet workhorses of the category.

Stage 4 – Cross-sport fusion

Finally, some consumers move beyond cycling-only products and look for socks that can cover their whole active routine: rides, runs, treadmill sessions, gym workouts and even light hiking. They still appreciate a snug, secure fit in a cycling shoe, but they want one compact drawer of socks that supports an entire active lifestyle rather than a single sport.

FAQs: Global Demand for Cycling Socks

Is the global cycling sock market still growing?

Yes. Recent reports estimate the dedicated cycling sock market at roughly USD 500 million in 2024, with forecasts of around USD 800 million by 2033, a CAGR of about 5–6%. Growth is driven by rising cycling participation, demand for performance apparel, and upgrades from generic sports socks to purpose-built designs.

Which regions buy the most cycling socks today?

Market studies show Asia-Pacific currently contributes the largest share of cycling sock revenue, followed by North America and Europe. Asia-Pacific is also the fastest-growing region thanks to expanding middle classes and booming road, indoor and e-bike communities, while Europe’s long cycling culture and high socks spending keep average prices and quality expectations higher.

What’s driving the shift from race-only cycling socks to everyday use?

The same technologies once used mainly in pro race kits—thin knits, compression bands and quick-dry yarns—are now being used for commuting, indoor cycling and even casual wear. As bikes replace short car trips and fitness becomes a daily routine, riders want socks that handle training rides but still feel and look normal off the bike.

Are cycling socks a good product category for e-commerce and private-label brands?

Yes. Cycling socks combine a relatively low unit cost with high replacement rates, strong visual differentiation and simple sizing, which makes them ideal for online bundles and repeat purchases. Data from the wider socks and athletic-socks markets shows strong growth in functional, fashionable products sold via online channels—exactly where cycling socks perform best.

Which cyclists tend to buy the most cycling socks?

High-volume riders are the heaviest buyers: road racers, gravel and MTB enthusiasts, indoor training users and year-round commuters. They ride several times per week, wash gear frequently and quickly notice when cuffs stretch or cushioning packs down, so they replace and upgrade more often than occasional leisure riders or tourists.

Conclusion

Cycling socks may be a small item, but they now sit at the crossroads of three strong forces: the steady growth of cycling apparel, the rise of commuting and everyday riding, and the ongoing upgrade from basic socks to performance-focused designs. Across regions and rider types, the pattern is clear: demand is moving from niche race gear to a stable, repeat-purchase category that blends comfort, style and versatility.

If you’re exploring this category more deeply or planning your next cycling sock line, Max Hosiery is ready to support you with flexible manufacturing, material know-how and long-term partnership thinking—not just one-off orders. Let’s build products that keep pace with where the global cycling market is heading.